Our Advisory Division boasts in-depth knowledge and expertise in the real estate sector as well as strong financial know-how. This allows us to provide clients with structured credit analysis and appraisal of the underlying asset to be recovered.

Advisory offers all-round financial consultancy. The Division plays a central role in assessments and due diligence, investigating areas like permit verification, urban planning, valuations, legal, fiscal and tax issues – all aspects of vital importance when drafting a Business Plan in the realty sector.

Our Advisory team supports the management of the various companies, drawing up business and financial plans – in compliance with the specific legal requirements of each case. These plans then serve as the basis for negotiation with creditors.

Our Advisory services

Due diligence

Due diligence consists of the appraisal, verification and analysis of the history and technical issues underpinning a given NPE in order to get a snapshot of the real status of the underlying real estate as the first step towards maximum value generation.

Due diligence involves:

- Valuation: we are able to value individual assets, real estate portfolios, NPLs and UTPs according to the best valuation methods: income approach, DCF, and comparative assessments.

- Legal analysis: our legal office supports the Advisory Division during due diligence into all legal aspects to get a clear picture of the current status of the property and how the workout procedure should be structured.

- Accounting and tax assessment: every deal involves an in-depth assessment of the indebted company’s balance sheet and any eventual collateral obligations it might have. This is followed by a close look at the diverse fiscal impacts any acquisition and workout process would have.

- Real estate valuation: the Advisory Division (Real Estate Section) assesses the legal implications of the underlying asset, looking at both the urban and administrative regulations involved – existing urban planning constraints, whether bound by any municipal agreement, specified use obligation, existing permits, etc.- as well as the real estate specifics: estimated square meters, state of completion, and worksite timeframe.

Business plan

The Business Plan contains the best overall workout strategy that will generate the highest value return for the particular case in hand.

Drawn up on the basis of the results of the due diligence, the Business Plan is made up of 3 key components:

- Economic and financial aspects: an Income Statement, Balance Sheet and Cash Flow drawn up for the full duration of the project.

- Sensitivity analysis: the Business Plan is stressed against variations of key items, i.e. variation of sale price/sqm.

- Timeframe of key activities to ensure overall project governance and value generation process.

Restructuring plans (in compliance with Arts. 182, 161 etc.)

Precarious financial situations – caused by an excessive debt burden or liquidity crisis – require solid action plans to rebalance the company’s capital structure and re-align operational cash flow with its debt servicing requirement.

Our Advisory team boast considerable experience in assisting companies to redress their balance sheets and restructure their financial debt, both through formal legal action or with out-of-court solutions in compliance with current crisis management provisions under Italian law.

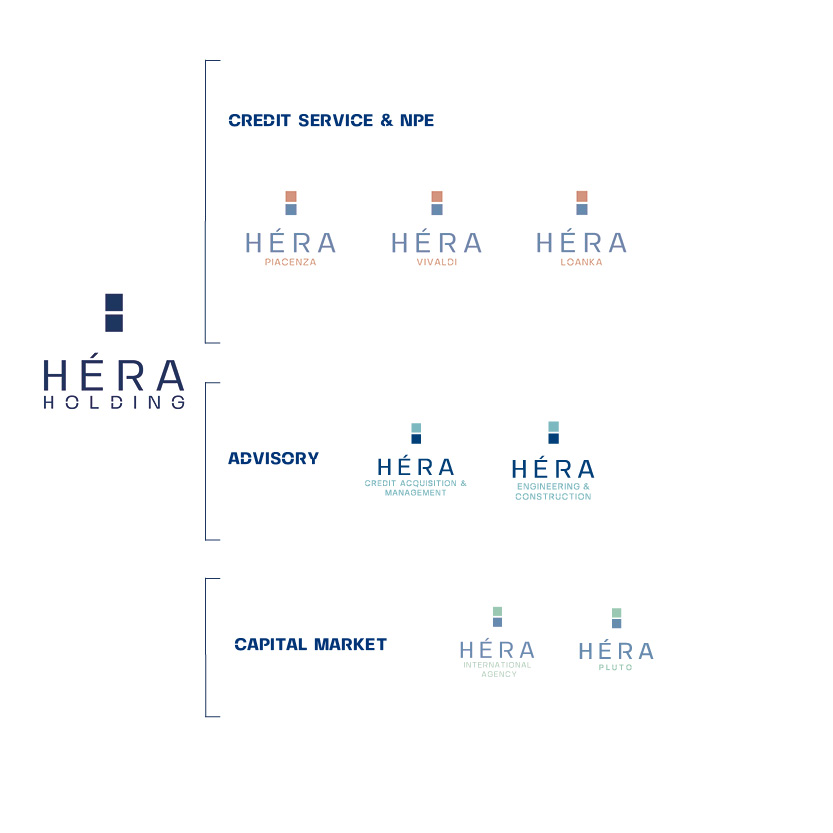

Group